Reminyl Er 8 Mg

Galantamine hydrobromide is used for the palliative treatment of mild to moderate dementia of the Alzheimer's type Alzheimer's disease.

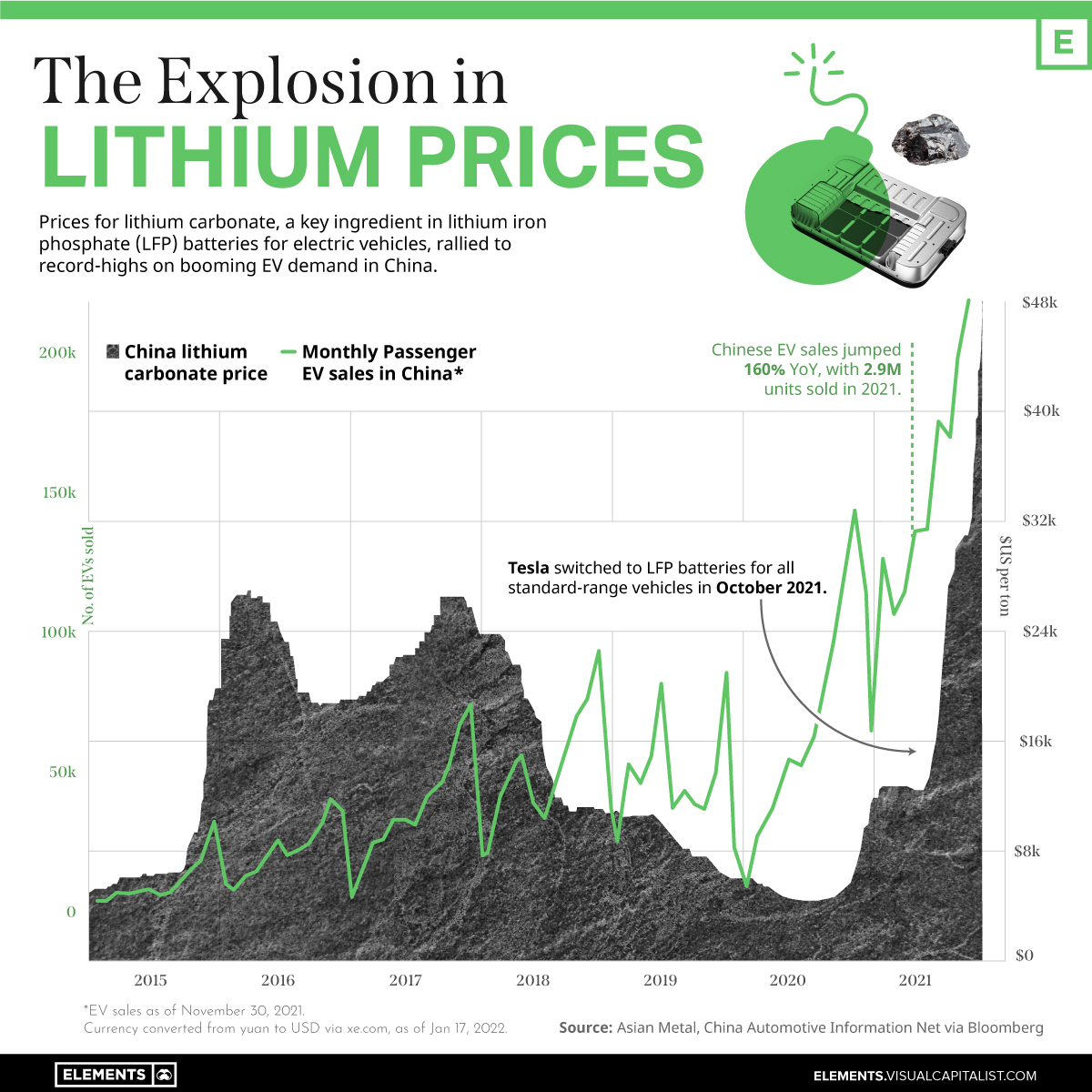

Lithium carbonate prices have been falling since the end of last year, and there are still no signs of stopping the decline. China's lithium-ion battery shipments are expected to be about 1 billion kWh this year, with growth rates set to drop sharply, Ouyang said.

have fallen from recent highs, but experts remain confident in the long-term outlook for the battery metal. Find out what moved the market in Q2. have been on the rebound since May after falling from November to April. Demand for the battery metal is expected to soar in coming decades, with questions about supply still to be answered. hit all-time highs in, but they kicked off under pressure after falling in Q4 of last year. On the supply side, COVID disruptions, slow restarts of idled capacity and new supply delays all fueled the price rally that the market saw from to, according to Fastmarkets.

Battery Metals and Materials. Since, SFA Oxford has pioneered growth opportunities for clients in the lithium, nickel, and cobalt markets. Platinum Group Metals Market. SFA Oxford is a world-renowned authority on PGM insights and has undertaken many complex assignments along the value chain. Green Hydrogen and Fuel Cells.

| Package | Per Pill | Total Price | Order |

|---|---|---|---|

| 30 Pills | $0.80 |

$23.99

|

Add to cart |

| 60 Pills | $0.65 |

$38.99

|

Add to cart |

| 90 Pills | $0.59 |

$52.99

|

Add to cart |

| 120 Pills | $0.52 |

$62.99

|

Add to cart |

| 180 Pills | $0.48 |

$85.99

|

Add to cart |

| 360 Pills | $0.43 |

$153.99

|

Add to cart |

Growth in revenue and deployment over the next three years will be markedly different from the overall projections. Lux Research says flow batteries, like vanadium redox units, will play a critical role in a future grid with a high wind and solar penetrations by providing carbon-free bulk capacity. The markets for smartphones, laptops, tablets, power banks, and consumer drones have all reached critical lithium prices and will only increase with population growth, says Lux Research. The electronic device market is expected to grow at 1. More likely, before 15 years comes along, a battery chemistry will cone along that uses no Lithium at all. Hey have a fair idea how far lithium can be developed.

Lithium is a member of the antimanic agents drug class and is commonly used for Bipolar Disorder, Borderline Personality Disorder, Cluster Headaches, and others. Prices are for cash paying customers only and are not valid with insurance plans. Important: When there is a range of pricing, consumers should normally expect to pay the lower price. There are currently no Manufacturer Promotions that we know about for this drug. Eligibility requirements vary for each program. There buying tegretol online currently no Patient Assistance Programs that we know about for this drug.

Yet despite the broad rout, futures in the crucial Chinese market are about a third cheaper. Chinese sentiment is being hurt by weak consumer and business confidence and an ongoing property crisis. It also offers an opportunity to profit from the arbitrage either by trading on paper, or by taking physical delivery of the Chinese contract and then converting the carbonate into hydroxide before selling on. Despite a rocky start for the Chinese contract, Asian funds in Hong Kong, Shanghai and Singapore have taken advantage of the price difference by buying Chinese futures and selling US ones, Hoffmann said. That has helped increase trading volumes.

rose strongly in and started to decline in December Nevertheless, the long-term drivers of lithium price have remained intact, offering a price floor that is expected to remain above historical average in spite of the numerous global ongoing lithium mining projects see graph below. Indeed, the main driver behind lithium demand is the global transition towards a greener economy. Hence, sales of EV are expected to almost triple from to, according to Fitch Solutions estimates. Chile and China are expected to increase their production over the next five years.

Producer sources told Fastmarkets that the downward room for their prices were limited due to production costs still being high. The most-traded January lithium carbonate futures contract on the Guangzhou Futures Exchange closed at, yuan per tonne on Thursday, down by 9, yuan per tonne from a closing price of, yuan per tonne a week earlier.

Amid a lack of certainty about when will improve Australian spodumene producers are continuing to curtail production. Lithium is in a holding pattern.

We use them to give you the best experience. Mining Industrial Minerals.

Our demonstration that we can keep pace with a rapidly evolving battery raw materials industry and its pricing demands has resulted in the LME selecting us as its partner to continue providing transparency to the lithium industry. Lithium hydroxide monohydrate Fastmarkets has been selected by the London Metal Exchange as its partner of choice to develop the lithium benchmark. Building on more than 30 years of experience in lithium prices the lithium market, we are looking forward to working with the LME and the physical market to develop a definitive roadmap. Out first aim is to provide a pricing mechanism that can be utilized throughout the supply chain and our second aim is to help to develop risk management tools for the industry. We are constantly looking at ways to improve our pricing mechanisms to reflect the changing demands of physical markets.

Industry-specific and extensively researched technical data partially from exclusive partnerships. Annual average price for battery-grade lithium carbonate. In, the average price of battery-grade lithium carbonate was estimated at 37, U. This figure is by far the highest price for battery-grade lithium carbonate recorded in the period of consideration. Lithium is a highly reactive soft and silvery-white alkali metal.